This article first appeared on IPE which can be seen at: Viewpoint: The governance evolution | Opinion Pieces | IPE

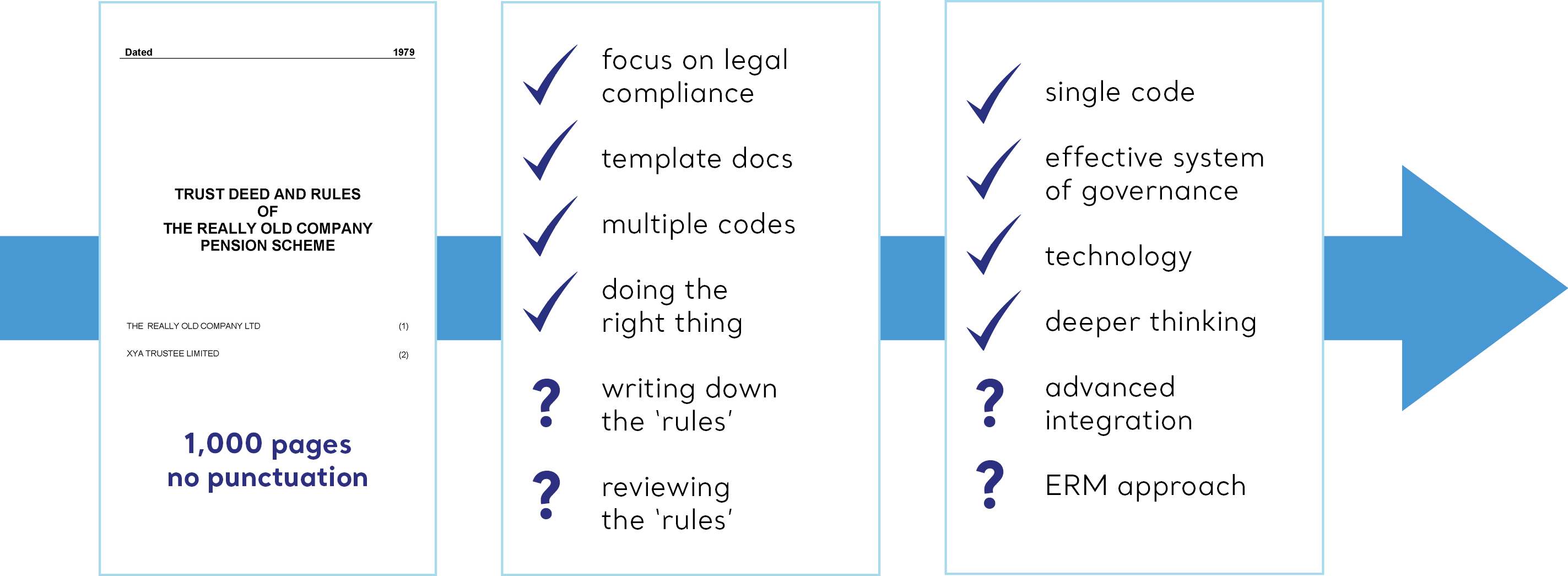

As a professional pension trustee I get to hear what a whole raft of scheme advisers are saying to trustee boards about The Pension Regulator’s (TPR) proposed new single code of practice and the related ‘effective system of governance’ (ESoG). At this time, it sounds like we’re dealing with a revolution.

The problem is, regulatory revolutions in the pensions world tend to come with high (often excessive) adviser fees. My advice to other trustees is to stop, take a step back and see this for what it is – an evolution, not a revolution.

Let’s take a couple of steps back before looking forward…

What is governance?

Governance is, essentially, a framework involving people, a plan and some processes. For pension trustees, nothing fundamental has changed – governance helps us be assured we’re doing what we need to, which is:

Pensions governance has been evolving since the first trust-based scheme came into being.

Methods of governance (the people part) are evolving too, with more options than ever now available. We started with trustee boards then some, typically larger, pension schemes introduced sub-committees to focus on certain delegated areas. More recently, as trust-based schemes have become legacy arrangements or moved along their journey plan, we’ve seen a rise in ‘new’ models including sole trusteeship and master trusts. Each has its pros and cons – the key is use whichever is most effective for helping achieve ‘the plan’.

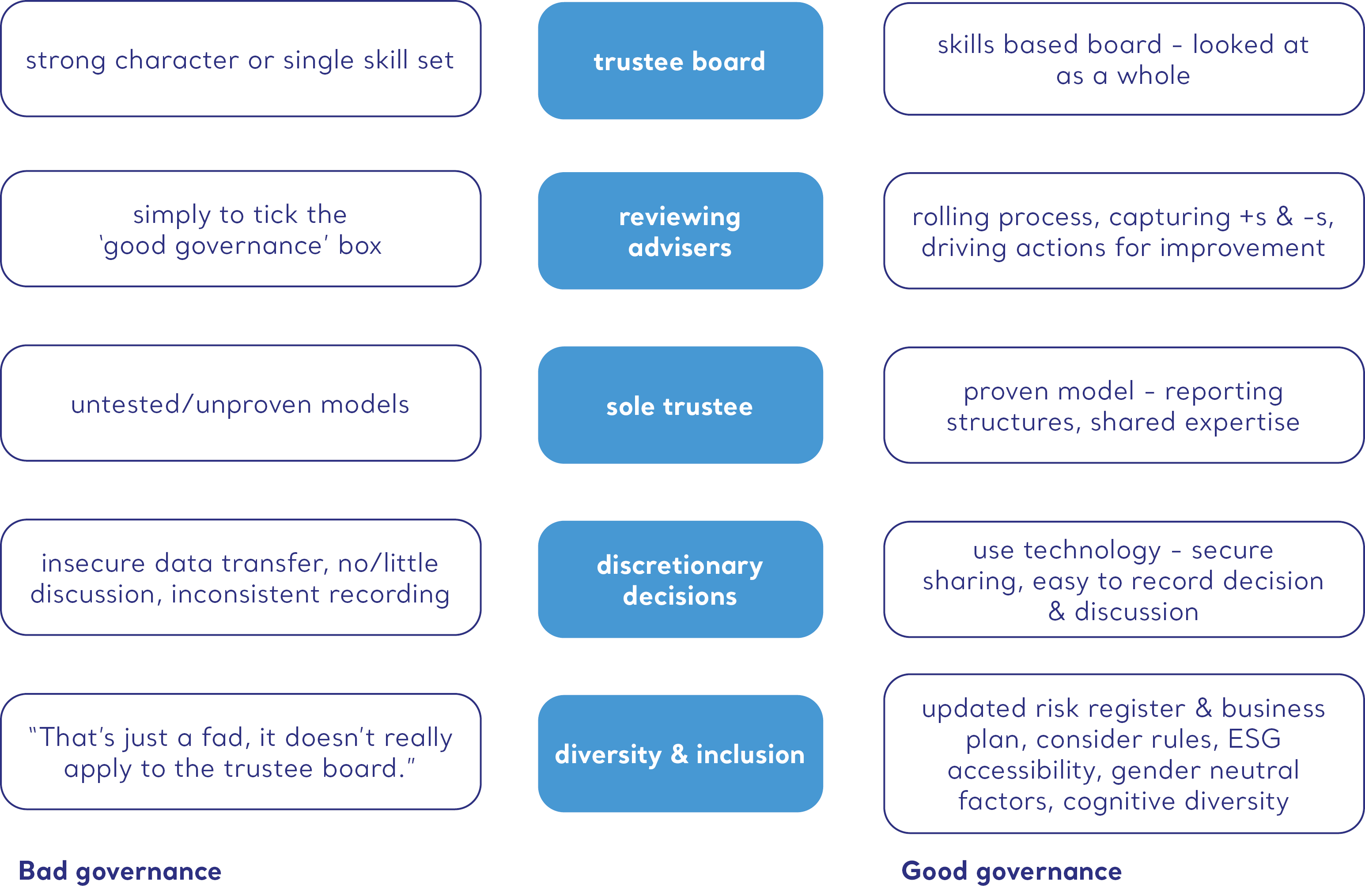

What is good and bad governance

One of the most clear examples of bad governance is trustee boards who don’t remember the simple rules. I could take almost any area of pension scheme management and find examples of both the good and the bad. Here are a few:

What should pension trustees be doing now?

Back to ESoGs and the single code. There’s plenty trustee boards can be doing now to prepare themselves for the next stage of the pension governance evolution. That’s the key point – what trustees (and their scheme secretary) can be doing. Advisers do not need (and are often not best placed) to do everything.

Start with the ‘process’ piece and keep it simple! Ask yourselves:

Then prepare for the future by considering what your governance culture will be, how will you monitor effectiveness and are you making best use of technology? Although advisers may be able to add value to this discussion can they, for example, answer the question about technology independently?

For preparatory work and analysis around single code compliance, we’ve seen adviser fees range from £250 for the provision of a template to help you carry out a review yourself to £30,000 for an analysis and proposed action plan presented to the trust board. Having an adviser do just the initial work is averaging around £9,000.

Remember, good governance involves the board effectively challenging advisers and their advice. Getting another viewpoint to supplement the board’s work will be more valuable, appropriate (ie good governance) and cost effective than handing over single code compliance to existing advisers.

‘ PSGS & 20-20 Trustees merge to form Vidett ’

Punter Southall Governance Services (PSGS) & 20-20 Trustees (20-20) have today announced they...

‘ Don’t be surprised that your gilt funds are being treated like an emerging market ’

You may have seen or heard about the article in the Financial Times about how Insight...